|

If you know Python please click here to learn how to unleash the awesome power of Agency big loan-level data. |

Meet The Team

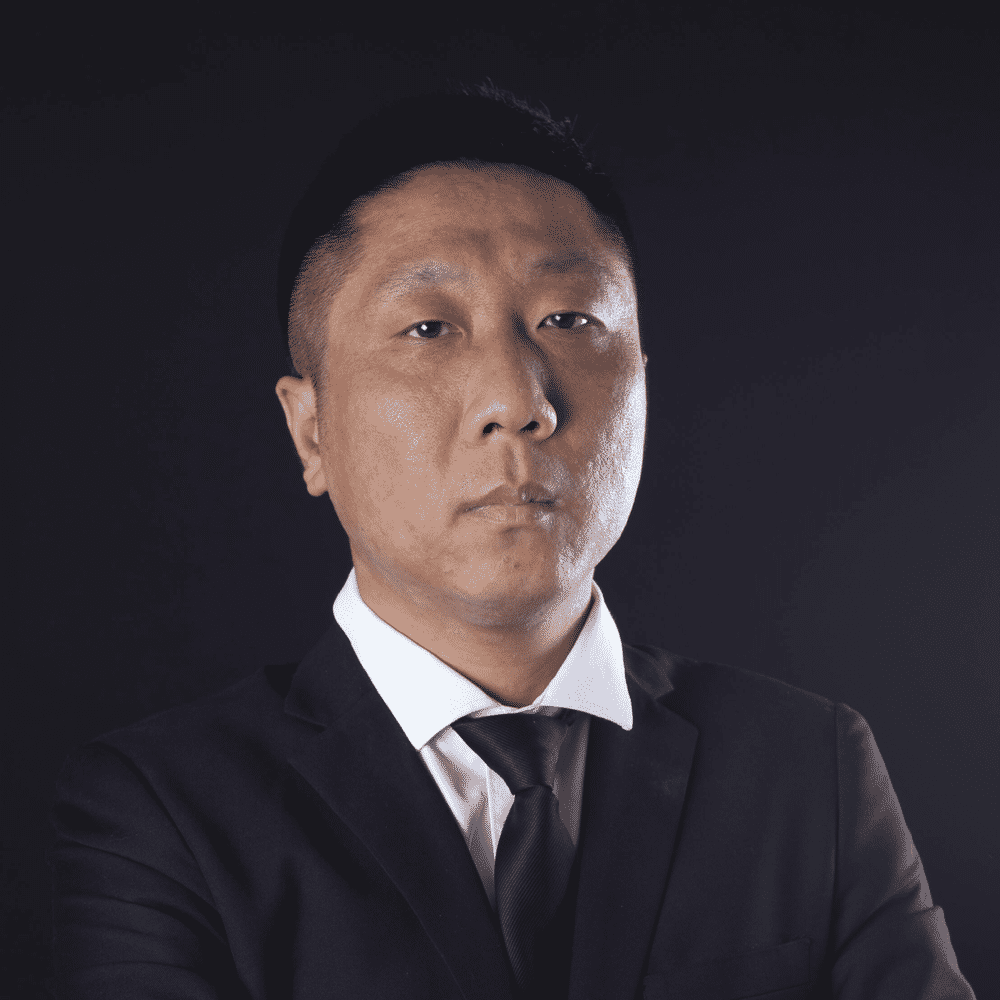

John C Wang

Chief Executive Officer, Chairman & Founder

John has more than forty years of hands-on experience in philosophy, science and enabling technology for the financial engineering services industry. As a visionary, Mr. Wang founded several firms as a system provider of knowledge-decision-feedback analytic applications for the mortgage banking industry, and obtained many patents among which including the Unified Quantum Electro Dynamic Field Effect Option Model and UBiquitous indeX (UBX™) matrix computing architecture technology. Earlier in his career, Mr. Wang built massively parallel credit-risk modeling systems for the financial engineering services industry and developed integrated Monte Carlo computing simulation systems on behalf of major Wall Street institutions.

Weimin Zhao

CHIEF TECHNOLOGY OFFICER

Weimin is responsible for the design, development, and deployment of our massively parallel computing technologies UBX™ (UBiquitous indeX matrix computing system network architecture). Over the past 15 years, he led the team in CPR&CDR and KDS to develop and create the most comprehensive MBS database using our UBX big data analytic platform, hosting over 500TB of data. Before joining KDS, he worked as a system engineer in Fannie Mae and the World Bank. He received his Ph.D. in Electrical Engineering from Johns Hopkins University and Bachelor of Engineering in Electronics from Tsinghua University at Beijing.

Larry Thoman

Chief Matrix Computing Officer

Larry has over 40 years of experience in Harvard matrix computing architecture based Field Programmable Gate Array (FPGA) chip-level hardware, real-time Verilog software, Big Data sorting & indexing and AI configured network topology design engineering works. Over 20 years of hands-on experience using these patented UBX core computing technologies to support our MBS/ABS analytics and modelling on-demand services. He received his BSc degree in Physics from California State University.

Fan Zhang

Chief Product Officer

Fan is responsible for the product line development, Artificial Intelligence (AI) Big data analysis, and the real time agency MBS Loan/Pool level Collateral and structured products analysis. Since her joining KDS Global in 2011, she created American short-range jump diffusion model for option pricing, and was playing key role in agency and non-agency MBS prepayment models using linear, non-linear and logistic regression techniques. Ms. Zhang holds a Master degree in Statistics from Columbia University and a Bachelor degree in Mathematics and Physics from Tsinghua University in China.

Dwyane Dong

Chief Operating Officer

Dwyane is responsible for the 7x24 non-stop production infrastructure design, planning, implementation, maintenance and super-high performance tuning and disaster recovery procedures for UBX™ network systems. Manage UBX™ system-level and application-level security requirements and develop N out of M layers of redundant fault tolerant operating environment. Identifies best MOA practice & methods and provides SDM project leadership and management in order to provide highest operational availability of the UBX™ network system. He has a Bachelor of Science degree in computer engineering from University of California at Santa Cruz.

Xiaoling Zhao

CHIEF INVESTMENT OFFICER

Xiaoling is in charge of our investment operations in China and USA. Specifically, she focuses on strategic partnerships, project management and client relationships. She established KDS global investment group for the first Structured Derivatives Fund (SDF) which was based on our U.S. patented unified quantum electro dynamic field effect option trading model. She has more than 15 years of experiences in M&A on Wall Street and was responsible for the rare earth principle investment for merchant banking deals. Ms. Zhao revolutionized mortgage index trading with ATOMS which is the first ever Available TBA-Only MBS Supply Index which also combines prepayment and default scoring.

Chris Pei

Chief Science Officer

Chris is responsible for developing the KDS Global portfolio risk-management platform that monitors portfolio-level risks in real-time, while streamlining hedging strategies based on the derived risk analytics. His responsibilities include risk management systems development and model enhancement. Dr. Pei's revolutionary research in quantum financial analysis led to the highly cutting-edge and world-changing QED Model which combines Quantum Electro Dynamic, Weak and Strong Interactions (Short Range), Electromagnetic Field (Long Range) Gravitational Field (Long Range), Differentiable Manifold Deconvolution, Space Time Energy Momentum Tensors, and Dark Matter Dark Energy with options trading. Dr. Pei holds a PhD in Physics at Johns Hopkins University, a Masters of Business Administration from the Wharton School and a Bachelor of Science in Physics from University of Science and Technology.

Calvin Miao

Chief AI Officer

Calvin is responsible for the development of artificial intelligence in financial engineering. He introduced Riemannian manifolds in his artificial intelligence algorithms, created a stock selection model and an option pricing model to provide entry and exit strategies. Calvin is also responsible for design and development of TBA™ and Specified Pool™ index returns and daily prices for the MBS trading market. He is a co-author of two U.S. Patent Applications: Unified TBA™ Return and price Algorithms and Tradable Specified Pool™ Index Return and daily Prices. He recieived his MSc degree in Mathematics, Harbin Institute of Technology.

Leslie Zhu

Chief UBX Officer

Leslie is responsible for the UBiquitous indeX matrix computing architecture (UBX) system life cycle development of 500,000 line of readl time C++ code.His team developed both UBX Python API and K-script cohort string and custom query reports for slicing & dicing of 500*10¹² Bytes big UMBS at pool & loan level data. He received his BSc degree in computer engineering from Xi Dian University in Xi'an, China.